Overview

In 2022 the Commission contracted with the Donahue Institute at UMass Amherst to update and expand the 2017 Regional Housing Market Analysis. The 2017 analysis included an assessment of housing supply and demand across the 15 towns of Cape Cod, subregions, and the region, for 2015 (the year of the latest data available at the time of analysis), and projections for 2020 and 2025.

This updated assessment identifies current and potential future gaps in the region’s housing market for resident households (both owners and renters) within various sets of income cohorts and provides baseline demographic and economic information. It also provides population and housing supply and demand projections through 2050 and captures additional detail about housing needs, particularly as they relate to the region’s workforce and year-round residents. This update was informed by a survey of Cape Cod residents intended to better understand their housing arrangements, what factors influence their housing choices, and whether they are satisfied with their current housing.

Limited Housing Options

The region's housing stock is less diverse, providing residents with fewer options, than that of the state and the country. With over 80% of homes in the region being detached, single-family homes, compared to just over 50% and 60% in the state and nation, respectively, smaller, multifamily housing is harder to come by. The region also has a much lower percentage of homes occupied by renters, compared to the state and country.

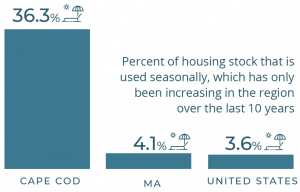

Seasonal Housing Puts Pressure on the Housing Market

In addition to a housing stock with fewer housing types and options, an unusually large share of the region's housing stock is used seasonally. More than one-third of the region’s housing units are seasonal units. Year-round residents must compete with second homeowners and investors who are purchasing homes for seasonal use, putting additional pressures on the housing stock to support not only year-round residents but also those seeking vacation homes in the region.

In addition to a housing stock with fewer housing types and options, an unusually large share of the region's housing stock is used seasonally. More than one-third of the region’s housing units are seasonal units. Year-round residents must compete with second homeowners and investors who are purchasing homes for seasonal use, putting additional pressures on the housing stock to support not only year-round residents but also those seeking vacation homes in the region.

This not only creates challenges for those looking to purchase a home in the region, but significantly impacts those looking for year-round rentals, as there is a strong financial incentive to rent out homes on a short-term or seasonal basis. Based on an analysis of 2021 data, it only takes two months for the revenues from a 3-bedroom short-term rental to exceed the revenue from renting a full-time, 3-bedroom year-round rental at the average monthly rent for Barnstable County.

Current Affordability Challenges

Housing prices have far outpaced incomes on the Cape causing a mismatch between housing market prices and what residents can pay.

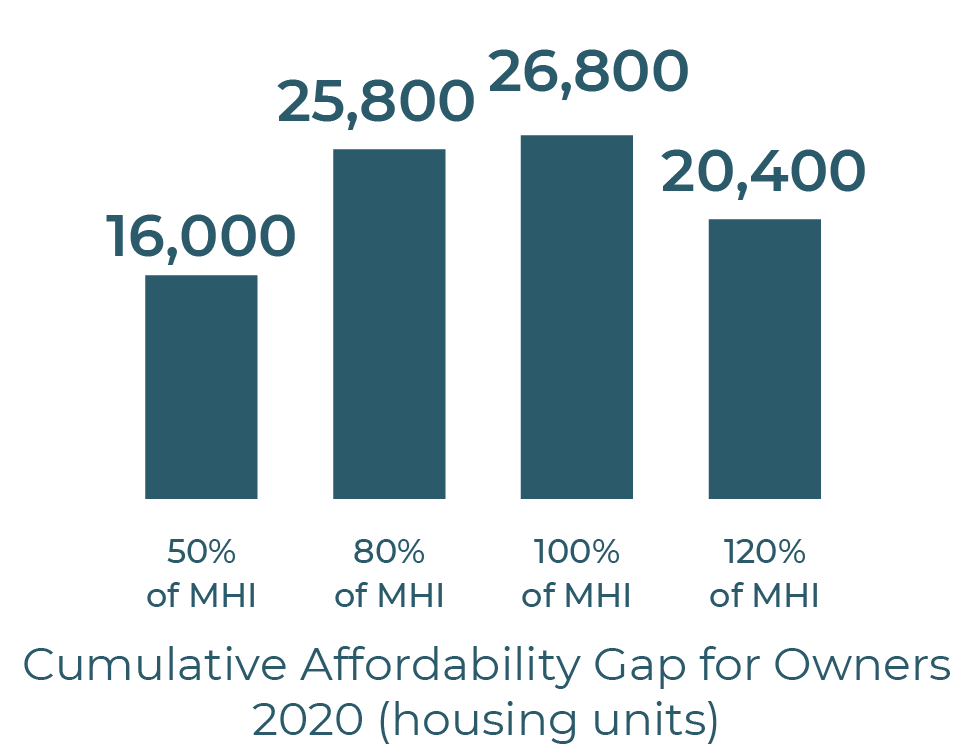

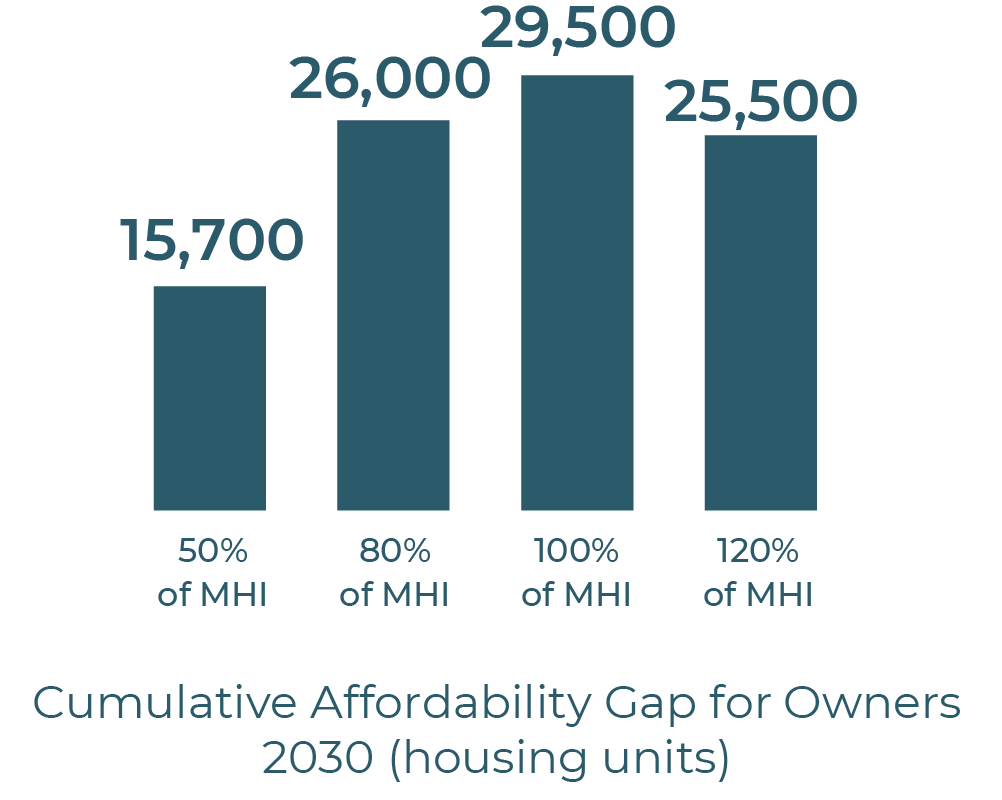

As part of this assessment, UMDI conducted affordability gap analyses for 2020 and 2030 for owners and renters for the county, subregions, and each town. The affordability gap is the difference between the estimated supply of housing units affordable to those households at a certain percentage of the median household income for owners or renters in a given area and the demand, assuming that housing cost is 30% or less of household income. It considers the existing population of owners and renters and the existing housing stock, distributed across different income levels.

As part of this assessment, UMDI conducted affordability gap analyses for 2020 and 2030 for owners and renters for the county, subregions, and each town. The affordability gap is the difference between the estimated supply of housing units affordable to those households at a certain percentage of the median household income for owners or renters in a given area and the demand, assuming that housing cost is 30% or less of household income. It considers the existing population of owners and renters and the existing housing stock, distributed across different income levels.

For 2020, it estimated that for those earning up to 100% of the median household income, there was a gap of approximately 26,800 housing units, that is, the demand for units affordable to those earning up to the median household income exceeded the supply by 26,800 units. For households with income over the regional median, there appears to be small surplus of owner housing (though still a cumulative gap), however it is worth noting that those with higher incomes can take up housing at any price, which can increase the gaps for any households at lower income levels.

Projections

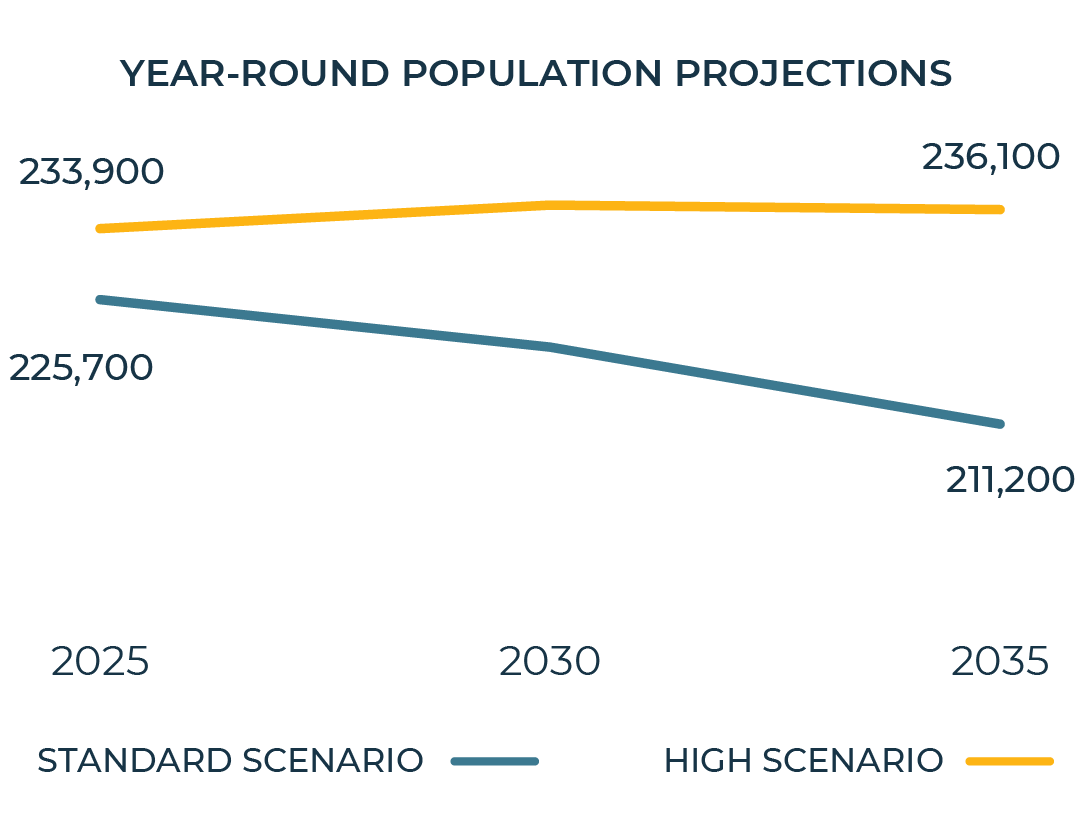

UMDI conducted projections based on two different scenarios: the standard projection assumes pre-pandemic migration trends continue and the high scenario assumes the higher pandemic migration trends persist. The housing demand projections are based on the population projections and also consider the seasonal housing demand trends. The housing supply projections do not take into consideration where and whether the housing units could be built, but rather provides numerical estimations into the future based on previous trends.

Population Projections

The standard scenario shows a decrease in year-round population over the next several decades, as the population ages and births decline. Additionally, both regionally and nationally, the number of people approaching the age of retirement is expected to decline in the coming decades as the last of the Baby Boomer generation ages out of this stage of life and the less populous Gen X generation enters it. The high scenario shows an increase in year-round population through 2030, but then a relatively stable population from 2030 to 2035, again due to the aging of the population and a decrease in birth rates, both a regional and national trend. Subregionally, however, all subregions except the Upper Cape are expected to see an increase in population through 2035 in the high scenario. This is because in the subregion of the Upper Cape the demographic shifts experienced in 2020 had the smallest impact on the overall population.

The standard scenario shows a decrease in year-round population over the next several decades, as the population ages and births decline. Additionally, both regionally and nationally, the number of people approaching the age of retirement is expected to decline in the coming decades as the last of the Baby Boomer generation ages out of this stage of life and the less populous Gen X generation enters it. The high scenario shows an increase in year-round population through 2030, but then a relatively stable population from 2030 to 2035, again due to the aging of the population and a decrease in birth rates, both a regional and national trend. Subregionally, however, all subregions except the Upper Cape are expected to see an increase in population through 2035 in the high scenario. This is because in the subregion of the Upper Cape the demographic shifts experienced in 2020 had the smallest impact on the overall population.

Housing Unit Supply and Demand Projections

Depending upon the scenario, the needs assessment estimates that demand for housing in the region could reach between 188,000 to 198,500 housing units through 2035, outpacing supply by anywhere from 11,000 to nearly 22,000 housing units. Despite a decrease in year-round population, the continued increase in housing demand is due to the continued and increasing demand for seasonal homes in the region.

It is important to keep in mind that this is without any interventions, assuming existing trends continue. Just as important is to note that these numbers are not necessarily targets for construction of housing, but rather provide an estimated need for more affordable housing in the region.

Projected Affordability Gaps

The affordability gap is expected to worsen for homeowners by 2030 for those earning up to 100% of the median household income. There remains a large predicted cumulative gap for rental housing units in the price range affordable to households at 80% and 50% of median household income. This is likely to cause these households to have to obtain housing that would otherwise be available to households at 100 and 120% of median.

Cape Cod Resident Housing Survey

The survey received 734 responses. On average, survey respondents have lived on the Cape for over two decades and have lived in their current homes for 14 years. The majority of respondents are homeowners (77%) while 12% are renters and 11% are living with friends or family or preferred not to respond. Most, whether owners or renters, live in single family homes (83%).

Housing cost was by far the most important factor when determining where to live, with 79% of residents indicating that the rent or sale price was “Extremely” or “Very” important. Of the other responses related to housing costs, property tax rate was also seen as an important factor, with nearly four-in-ten (39%) of respondents indicating that it was “Very” or “Extremely” important. Other factors of high importance were distance to your job (41%), being near family and friends (38%), quality of public schools (39%), distance to saltwater beaches (37%), and personal connections to the community (39%). Availability of public transportation was seen with the least importance, with only 6% of respondents viewing it as “Very” or “Extremely” important in their decision to live in their current residence.

A key finding of the survey is that while both renters and homeowners face affordability challenges, renters are particularly challenged and face greater housing instability. Nearly eight in ten renters (79%) responded that they had moved out of a home that was no longer available to them, compared to just under 20% of owners.

Housing stability is a pressing concern for renters. The vast majority of homeowners experienced stable housing over the past three years, with 84% reporting that they had not moved in that timespan. In contrast, only 54% of renters had not moved in the past three years and a quarter had moved two or more times in the past three years. Over 60% of Cape renters indicated that they were worried that they may not have stable housing in the next twelve months.

The needs assessment articulates that these pressing issues will require action at the local and regional levels to address them and make more housing available for renters at a wide range of income levels, as well as bring home ownership into reach for year-round residents on the Cape. The future vitality of the communities on Cape Cod depends on making changes now in order to build a sustainable and inclusive region.

You can access the full report from the UMass Donahue Institute here.

Values in graphics on this page have been rounded.

Contact

-

Chloe Schaeferchloe.schaefer@capecodcommission.org