As the COVID-19 pandemic is reshaping the way people are living and working, it is having profound effects on the local real estate market. The Cape Cod Commission worked with the UMass Donahue Institute and the Center for Public Opinion at UMass Lowell on a 2021 Cape Cod New Homeowner Survey. The survey was designed to better understand homeowners' decisions to purchase a home on the Cape during the pandemic, as well as near- and long-term plans for the use of their newly purchased home. The survey builds off of the Commission's past survey efforts for Cape Cod Second Homeowners.

Results

A random sample of 5,850 homeowners who purchased their Cape Cod home between April 2020 and May 2021 were invited to respond to the survey. In total, 403 homeowners responded to the survey, which is a response rate of approximately 7 percent.

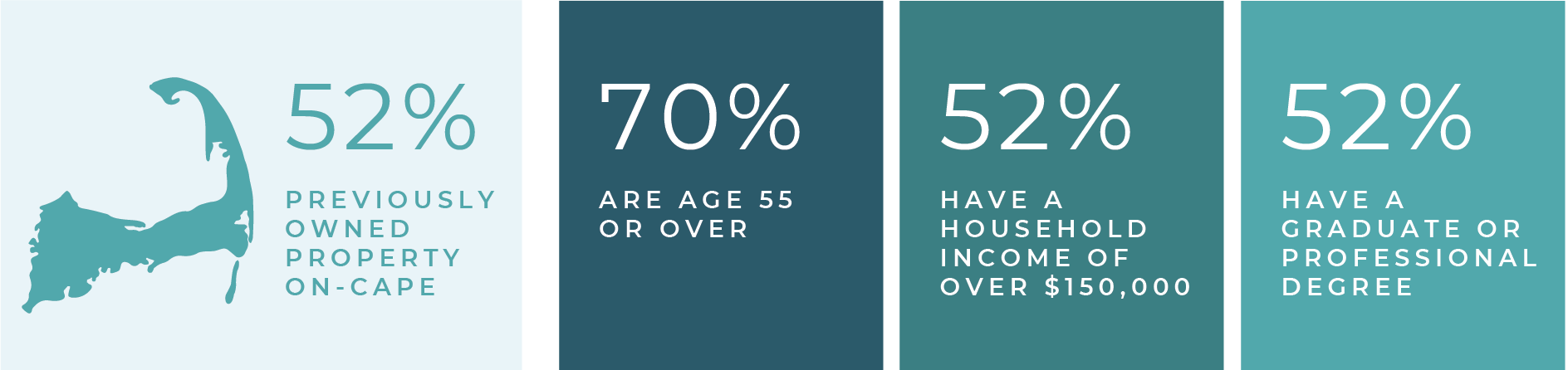

The responses show that the majority of new homeowners (66%) plan to live on Cape Cod year-round, are over the age of 55 (70%), and have relatively high incomes (over half reported incomes of over $150,000 per year). Most respondents purchased single-family homes (79%).

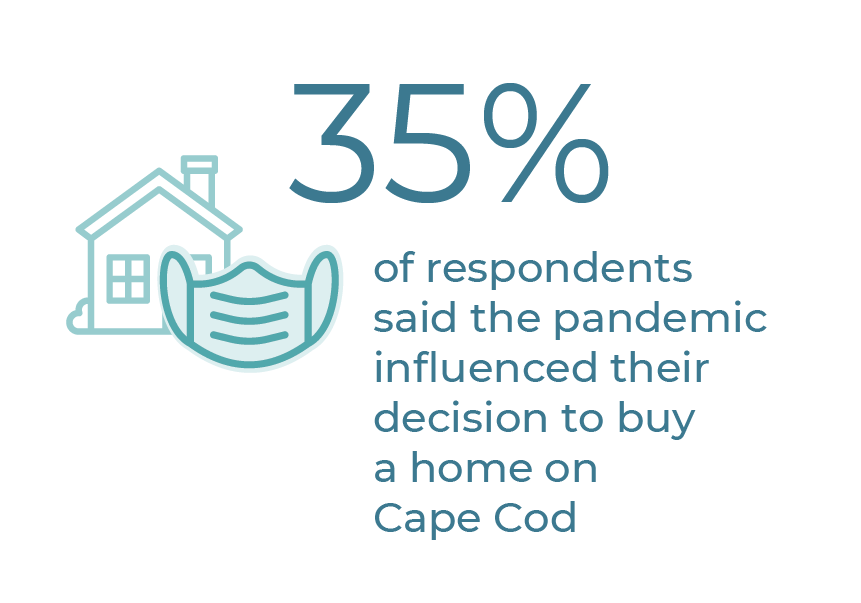

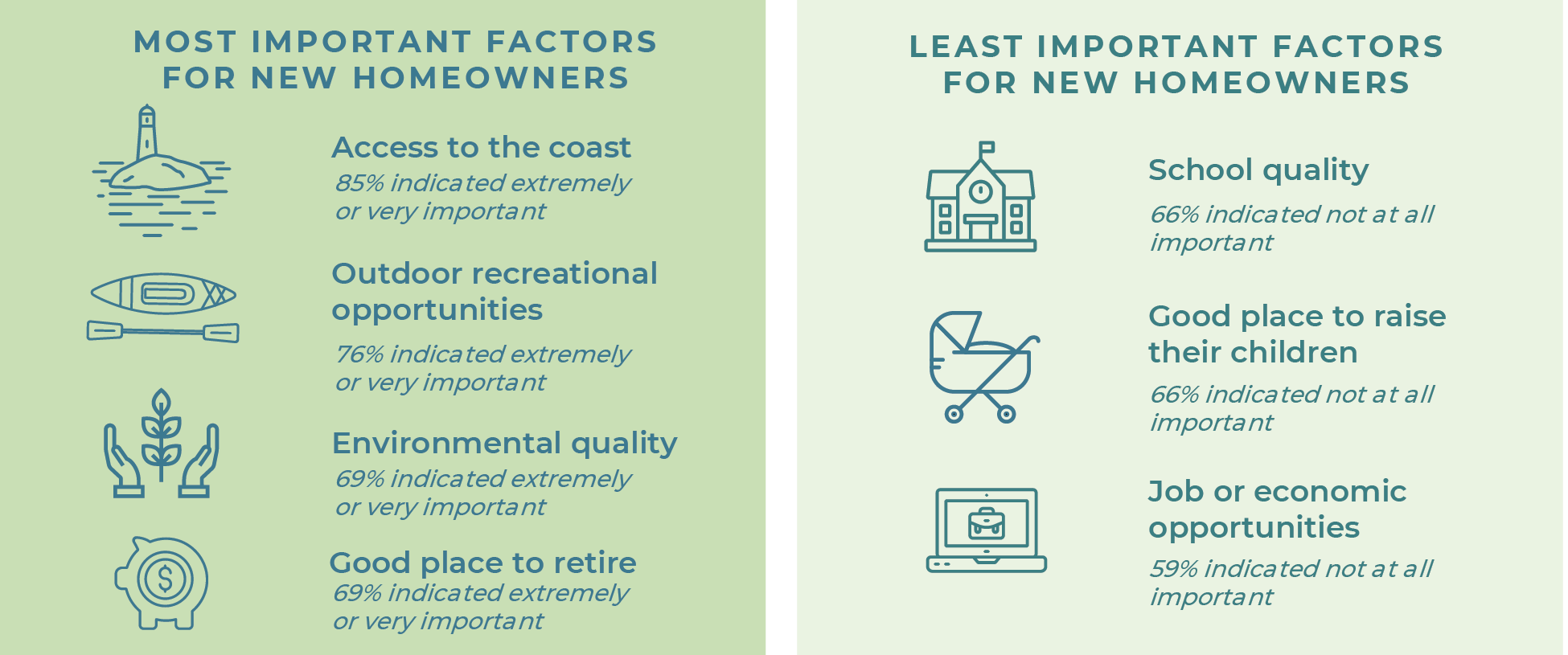

About one-third (35%) of respondents said the pandemic influenced their decision to buy a home on Cape Cod. The most commonly cited ways in which the pandemic influenced their decision included the ability to work remotely, an increased desire to live near outdoor recreation opportunities and in a less dense area, and the desire to have more living space. Cape Cod’s amenities, such as access to the coast, outdoor recreational opportunities, and environmental quality, were the most important factors new homeowners considered, regardless of whether the pandemic influenced their plans or not.

About one-third (35%) of respondents said the pandemic influenced their decision to buy a home on Cape Cod. The most commonly cited ways in which the pandemic influenced their decision included the ability to work remotely, an increased desire to live near outdoor recreation opportunities and in a less dense area, and the desire to have more living space. Cape Cod’s amenities, such as access to the coast, outdoor recreational opportunities, and environmental quality, were the most important factors new homeowners considered, regardless of whether the pandemic influenced their plans or not.

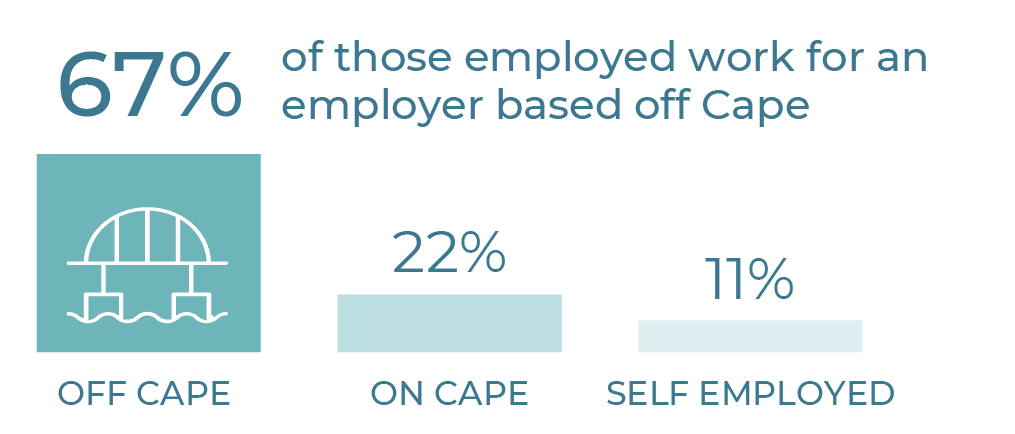

Given the rise in remote work during the pandemic, the survey asked about the current and predicted employment status and location of work for the new homeowners. At the time of purchase, 69% of respondents were employed, and 67% of those employed worked for an employer based off-Cape. Many respondents were working remotely (42%), but in six months that number is expected to lower to 24%. The top fields respondents reported working in include professional and technical services, health care and social assistance, education services, finance and insurance, and information, media, or telecommunications. The majority of new homeowner respondents say that they have been and/or will use their Cape Cod home as their primary residence at some point in the future.

Given the rise in remote work during the pandemic, the survey asked about the current and predicted employment status and location of work for the new homeowners. At the time of purchase, 69% of respondents were employed, and 67% of those employed worked for an employer based off-Cape. Many respondents were working remotely (42%), but in six months that number is expected to lower to 24%. The top fields respondents reported working in include professional and technical services, health care and social assistance, education services, finance and insurance, and information, media, or telecommunications. The majority of new homeowner respondents say that they have been and/or will use their Cape Cod home as their primary residence at some point in the future.

This report provides an important first glimpse at the motivations and thinking of new homeowners entering the Cape Cod housing market during an ongoing pandemic. This research is a critical first step in understanding what is driving the choices of new homeowners in the region and provides policymakers and planners with the ability to revisit these trends in the coming years as residential and work patterns stabilize.

Contact

-

Chloe Schaeferchloe.schaefer@capecodcommission.org